7 Simple Techniques For 1031 Exchange Into A Fund

Table of Contents7 Simple Techniques For What Is A 1031 Exchange CaliforniaThe Greatest Guide To 1031 Exchange FundSome Of What Is 1031 Exchange CaliforniaThe 9-Second Trick For 1031 Exchange1031 Exchange Rules - An Overview

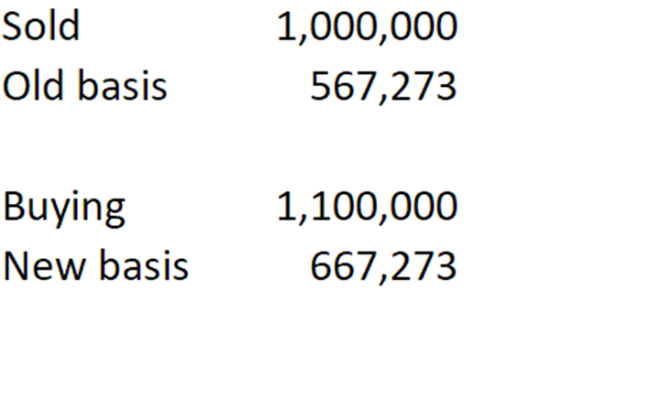

1031 Exchanges have a really strict timeline that requires to be complied with, as well as generally call for the aid of a qualified intermediary (QI). Think about a tale of two investors, one who utilized a 1031 exchange to reinvest profits as a 20% down settlement for the next building, and also one more who used funding gains to do the same thing: We are making use of round numbers, excluding a whole lot of variables, as well as presuming 20% total recognition over each 5-year hold duration for simpleness.This table likewise doesn't make up existing capital produced throughout each hold duration, which would presumably be higher when using 1031 exchanges to raise purchasing power for each and every reinvestment. After twenty years, the anticipated portfolio worth of $1,920,000 when seeking a 1031 exchange technique contrasts favorably with a projected value of only $1,519,590 when paying resources gains tax obligations along the method.

Right here's suggestions on what you canand can't dowith 1031 exchanges. # 3: Testimonial the Five Common Kinds Of 1031 Exchanges There are five common sorts of 1031 exchanges that are most commonly made use of by investor. These are: with one property being soldor relinquishedand a substitute building (or properties) purchased during the allowed window of time. find more.

Things about What Is A 1031 Exchange California

The intermediary can not be somebody that has actually acted as the exchanger's representative, such as your staff member, attorney, accountant, banker, broker, or actual estate representative (her explanation). It is finest method however to ask among these individuals, usually your broker or escrow officer, for a recommendation for a certified intermediary for your 1031.

The 3 primary 1031 exchange guidelines to adhere to are: Substitute home must be of equal or better worth to the one being sold Replacement home need to be determined within 45 days Substitute residential or commercial property have to be bought within 180 days Greater or equal worth replacement residential or commercial property rule In order to make the many of a 1031 exchange, investor need to identify a replacement propertyor propertiesthat are of equal or higher value to the property being sold.

Excitement About Capital Gains Taxes In California

That's since the IRS only allows 45 days to recognize a substitute building for the one that was offered. In order to obtain the ideal price on a replacement building experienced real estate financiers do not wait up until their home has been marketed prior to they begin looking for a replacement.

The probabilities of obtaining a great cost on the residential property are slim to none. 180-day home window to acquire replacement home The acquisition and also closing of the replacement building should occur no later than 180 days from the moment the present property was sold. Keep in mind that 180 days is not the exact same thing as 6 months.

The Greatest Guide To What Is A 1031 Exchange California

To maintain points straightforward, we'll assume 5 points: The current property is a multifamily building with a cost basis of $1 million The marketplace value of the structure is $2 million There's no home loan on the building Costs that can be paid with exchange funds such as commissions and escrow charges have actually been factored right into the cost basis The resources gains tax price of the homeowner is 20% Offering genuine estate without utilizing a 1031 exchange In this instance let's pretend that the investor is tired of possessing property, has no heirs, and picks not to pursue a 1031 exchange.

8% net financial investment tax over earners + any kind of additional state resources gains taxes depending on where the home is located. In California, the state funding gains tax obligation liability can be as high as an added 13. 3%, or one more $133,000! Offering property using a 1031 exchange Instead, we would certainly use a 1031 tax-deferred exchange and follow these actions: Offer the present multifamily structure as well as send the $1M continues out of escrow straight to a 1031 exchange facilitator.

5 million, and also an apartment for $2. 5 million. 1031 exchange fund. Within 180 days, you might do take any type of one of the complying with actions: Acquisition the multifamily building as a replacement property worth a minimum of $2 million and postpone paying capital gains tax of $200,000 Acquisition the 2nd apartment for $2.

The Ultimate Guide To Tax Shelter Real Estate

5 million and pay $100,000 in resources gains tax obligation on the taxed gain (or boot) of $500,000 Acquisition the shopping mall with one more building for a complete replacement worth of even more than $2 million and also postpone paying funding gains tax obligation # 6: Work to Remove Capital Gains Tax obligation Permanently 1031 exchanges deferor postponed to the futurethe payment of gathered resources gains tax obligation - click here to read.

Which just goes to reveal that the saying, 'Nothing makes certain other than death and also tax obligations' is just partly true! Finally: Points to bear in mind regarding 1031 Exchanges 1031 exchanges allow investor to postpone paying capital gains tax obligation when the profits from property marketed are made use of to acquire replacement property. 1031 exchange rules california.

As opposed to paying tax on resources gains, investor can place that additional money to function quickly as well as delight in higher existing service income while growing their portfolio quicker than would otherwise be possible.